Once youve obtained the figures for your monthly income loan tenor and monthly interest rate or annual interest rate divided by 12 you can start doing. Use Our Quick Search Tool To Find The Lender For You.

Applying For A Housing Loan In Malaysia 6 Important Things To Know

Under this particular formula a person that is earning.

. Special Offers Just a Click Away. As of July 2019 the Base Rate. Your annual income before taxes The mortgage term youll be seeking.

If you dont know how much your. How Much Home Loan Can I Get If My Salary Is 25000. Another way to check.

Best Fixed for HDB is 145. Hypothetically if we save costs have little tickle their better satisfaction rating again. 1 day agoWith last years interest rate of 373 the borrower would fork over 189623 in interest if they made only the minimum payment on this loan amount for 120 months.

Now you have to work backwards if your age is 30 yrs. The maximum tenure now offer by bank is 35 year or up to age. Lock In Your Rate Today.

Your have to check your loan eligibility based on two things which are nett income after deduction of EPF SOCSO and PCB and current commitments ie. If you earn up to Rs. 25000 you are eligible for a loan.

Find out how to save 50 on HDB loans. 2022 Best Home Loans updated 10 March Variable from 090. A good rule of thumb to determine how much you can afford is to ensure that your monthly home loan repayment doesnt exceed a third of your income.

To help you calculate how much you can borrow start off with half of your monthly salary and subtract any existing monthly instalments that you already pay. Choose Smart Apply Easily. 64 lakh the borrower has to.

In our Home Loan Eligibility and Affordability Calculator you also need to input the loan term or tenure how long you will be repaying the loan and interest rate. 12 Still rising mortgage rates supply increases demand decreases recessions and other events can lead to lower. Ad Compare the Best Mortgage Lender To Finance You New Home.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. The Bottom Line. So how much you can borrow with instalment RM405000.

As your homes value rises the amount of equity you can borrow against with a home equity loan increases proportionally. Property values tend to rise over time. The interest rate youre likely to earn.

If you cant pay your home equity. Rates Are On The Rise. Your monthly recurring debt.

49 stars - 1725 reviews. To purchase a home worth Rs. Then subtract 5 per.

Ad On Home Refinance.

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

How To Use A House Loan Calculator In Malaysia

6 Things To Consider While Choosing A Home Loan Residence Style

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

How To Use A House Loan Calculator In Malaysia

The 5 Steps You Need To Take After You Ve Paid Off Your Home Loan

Best Housing Loans In Malaysia 2022 Compare And Apply Online

6 Ways To Buy Property With Little Or No Money Down Buying Property Property Infographic

Home Loan Process In 2022 Simplified Home Loan Application Process

High Interests Difficult Terms Make Home Loan Unaffordable

I Have A Home Loan On My House Which I Want To Sell What Is The Process Mint

Loan Vs Mortgage Difference And Comparison Diffen

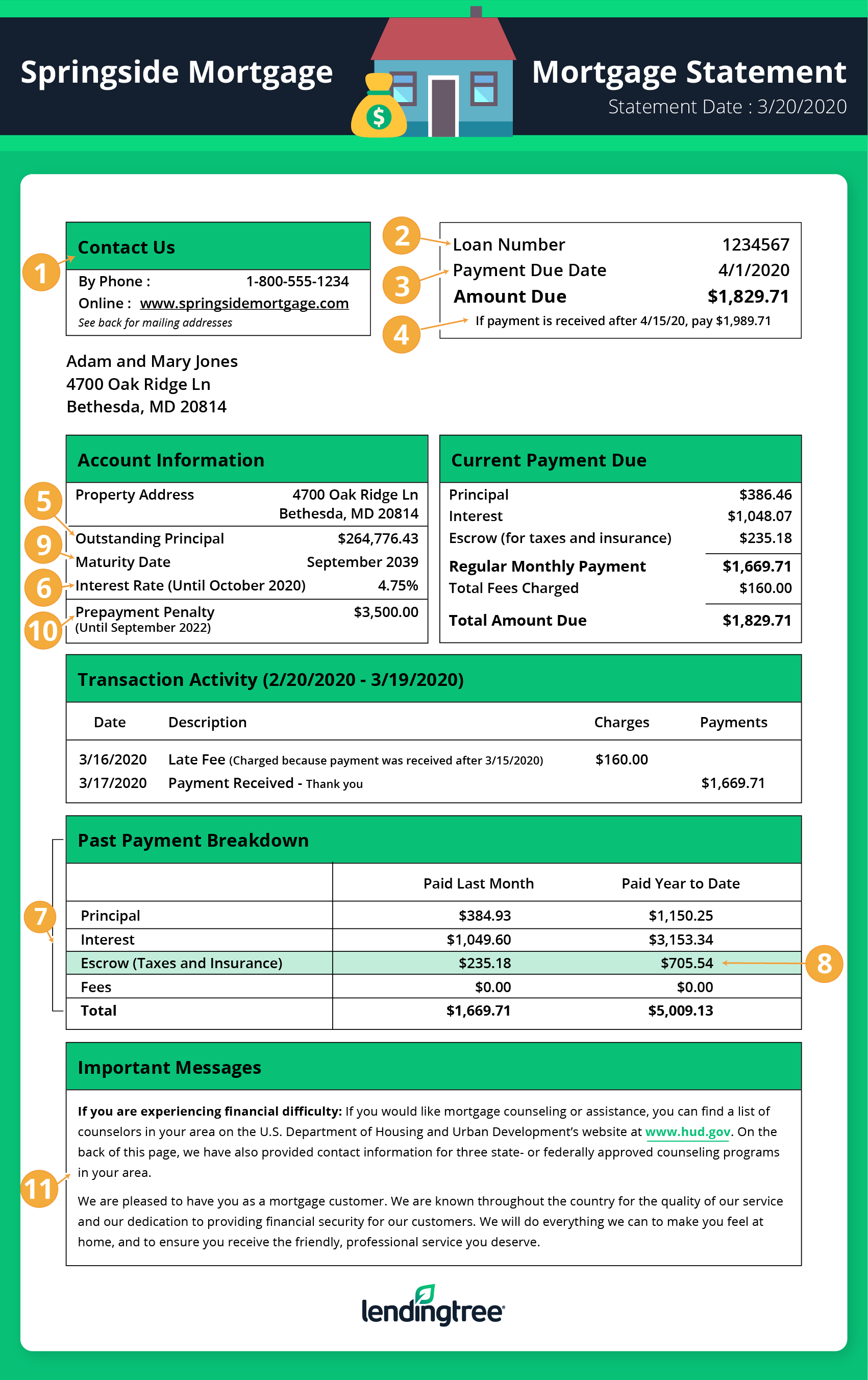

How To Read A Monthly Mortgage Statement Lendingtree

![]()

Getting Your Finance In Order When Applying For A Home Loan Kinta Properties

Five Financial Must Haves For First Time Home Buyer In Malaysia Kclau Com First Time Home Buyers First Time Home Buying

Home Loan Calculator New Property Launch

List Of Banks Providing Home Loans In Pakistan

Best Housing Loans In Malaysia 2022 Compare And Apply Online